Commercial Claims Appraisal, Public Adjusters & Construction Experts

Garrett Claims Group are the experts you need for your insurance claim.

Claims Managed

Located directly on the Atlantic Coast, the association contacted us a year after ongoing repairs and attempted settlement offers. Issues of unit owner vs. association owned interest coupled with incurred contractor expenses were extrapolated for the insurance carrier. Resulting in a favorable negotiated settlement

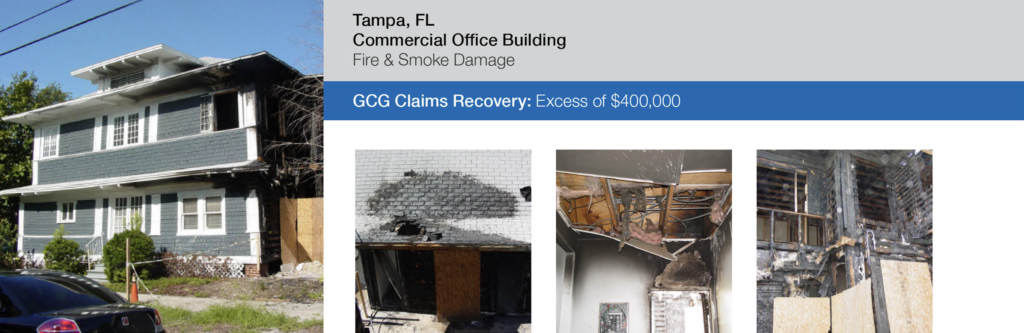

A two-story historical office building was consumed by fire via electrical short. Structural and cosmetic damages ensued along with heavy smoke and heat. Plan review and knowledge of State and Local Building Codes for Ordinance or Law Coverages were extrapolated from loss values that assisted the parties to solidify an amicable settlement.

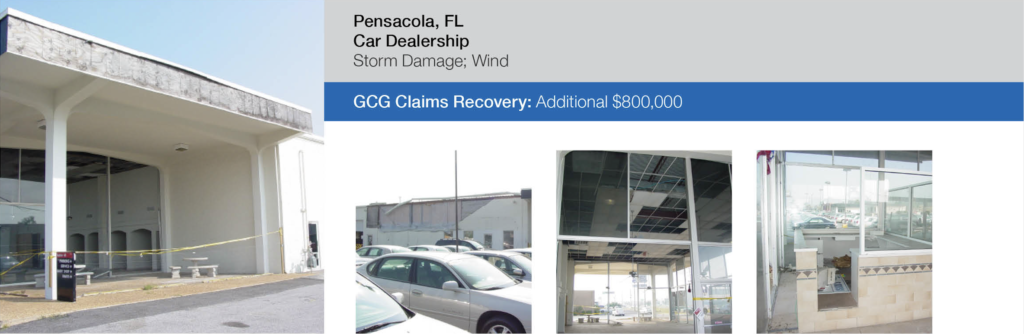

Wind damages breached the roof, exterior masonry wall, and store front glass walls, impacting both structural and cosmetic components. Dispute resolved through adjustment for the building, signage, lighting and business property.

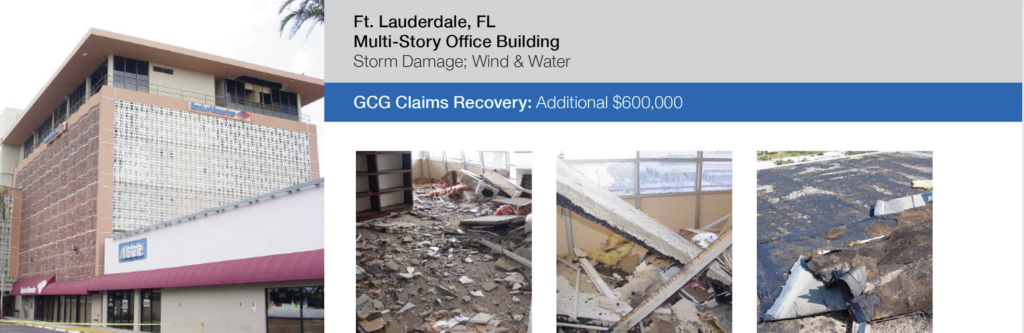

Office Building with multiple tenancy sustained windstorm damages to the roofing systems, cooling system, and windows that resulted in severe interior damages. Our efforts extrapolated landlord and tenant responsibilities for damages coupled with identifying the excess insurance carriers exposure over the primary policy.

Maximizing Your Commercial Insurance Claim: The Power of Hiring a Public Adjuster

In the aftermath of a disaster or property damage, navigating the complexities of a commercial insurance claim can be daunting for business owners. From assessing damages to negotiating with insurance companies, the process can be overwhelming and time-consuming. However, there’s a solution that can alleviate the burden and maximize your claim: hiring a public adjuster. In this comprehensive guide, we’ll explore the invaluable role of public adjusters in commercial insurance claims and how they can help you secure the compensation your business deserves.

Before delving into the benefits of hiring a public adjuster, it’s crucial to understand the intricacies of commercial insurance claims. Commercial property insurance typically covers damages caused by events such as fires, floods, storms, vandalism, and other unforeseen incidents. However, navigating the claims process requires meticulous documentation, negotiation skills, and an understanding of insurance policies.

A public adjuster is a licensed professional who works on behalf of policyholders to assess damages, prepare and file insurance claims, and negotiate with insurance companies to ensure fair compensation. Unlike insurance company adjusters who represent the insurer’s interests, public adjusters advocate for the policyholder, ensuring that their rights are protected throughout the claims process.

Expert Assessment of Damages

Public adjusters possess specialized knowledge and expertise in assessing commercial property damages. They conduct thorough inspections, document all damages meticulously, and provide an accurate assessment of the loss, ensuring that no damage goes unnoticed or underreported.

Maximized Insurance Settlements

One of the primary benefits of hiring a public adjuster is their ability to maximize insurance settlements. By leveraging their negotiation skills and knowledge of insurance policies, public adjusters advocate for the highest possible compensation for your commercial claim. They ensure that you receive fair and equitable compensation to cover the cost of repairs, replacement, business interruption, and other losses.

Navigating Complex Insurance Policies

Commercial insurance policies often contain complex language and exclusions that can be difficult for business owners to interpret. Public adjusters have a deep understanding of insurance policies and can navigate the fine print to ensure that you receive the coverage you’re entitled to under your policy. They help you understand your rights and obligations, guiding you through the claims process with clarity and transparency.

Timely Resolution of Claims

Dealing with insurance claims can be time-consuming, especially for busy business owners. Public adjusters take the burden off your shoulders by handling all aspects of the claims process, from initial assessment to final settlement. They expedite the process, ensuring timely resolution of your commercial claim so that you can focus on running your business without disruptions.

Professional Representation and Advocacy

Insurance companies have their own team of adjusters and legal experts working to minimize payouts. Hiring a public adjuster levels the playing field by providing you with professional representation and advocacy. Public adjusters have the experience and resources to challenge insurance company assessments, negotiate on your behalf, and ensure that your best interests are protected throughout the claims process.

In conclusion, hiring a public adjuster for your commercial insurance claim can make a significant difference in the outcome of your claim. From expert assessment of damages to maximizing insurance settlements and navigating complex insurance policies, public adjusters provide invaluable support and advocacy to business owners facing property damage or loss. By entrusting your claim to a public adjuster, you can rest assured that your rights are protected, and your business receives the compensation it deserves. Don’t navigate the claims process alone – enlist the expertise of a public adjuster and secure the financial recovery your business needs to thrive.